Steps by Steps Tutorial - Withdraw Funds in PayPal Account (Malaysia)

I just made a transaction of my INDIA registered Google AdSense account with an AdSense-approved website to a buyer in last week.

The payment method we agreed upon before the deal was PayPal and I'm here to share how I withdraw money from PayPal to my bank account in Malaysia - Maybank Berhad in year 2022.

How to withdrawl money from PayPal to bank account in Malaysia (2022)?

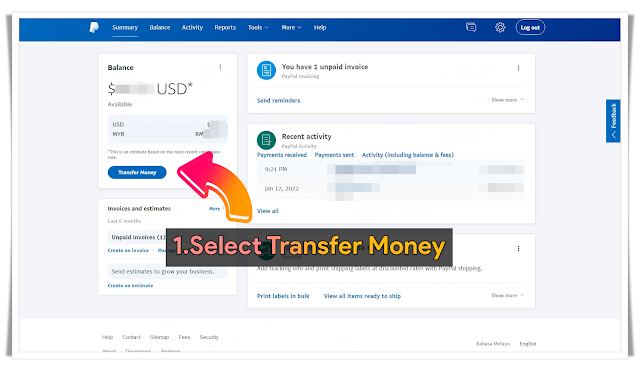

First of all, login your PayPal Account.

Next, click "Transfer Money" at the summary page. (Only Available when there is money on your PayPal account)

Then select a Bank, example here is Malayan Banking Berhad (Maybank).

If you haven't link a bank to PayPal yet, you may click the first blue + symbol to add your bank to PayPal Account.

After that, click next at the bottom.

Enter the transfer amount and check the fee, then click next.

Check all the details such as Bank account number and Balance's currency, the fee charged by PayPal was RM3.18.

If there is nothing wrong, you may click Transfer at the bottom.

Now I have transferred money out from PayPal to bank accounts (Maybank) and the withdrawal will be completed in 2 to 3 days.

You will receive an Email from PayPal instantly or few minutes after the withdrawal like this.

One day later, I received the withdrawn funds from PayPal to my Maybank account.

Opinions to use PayPal for Transaction (Malaysia)

The Google AdSense approved site transaction I dealt with the buyer was not bad and we agreed the pricing at my favorable and his/her acceptable price. However, I still lost around 12% of the gross amount I can received based on the currency rate few days ago.

I was charged with a currency conversion fee of 4.5% using by using PayPal as the method to receive the funds transfer internationally. Not to mention there were also some PayPal Transaction Fee and PayPal Withdrawal Fee.

Besides, I'm not quite sure whether did PayPal increase their transaction fee or not, but it did increase the withdrawal fee from RM3.00 to RM3.18.

Based on the official PayPal website, it still states that there will be no fee for withdrawals of MYR400.00 and above and MYR3.00 for any withdrawals less than MYR400.00.

So why I was charged RM3.18 by PayPal instead of the agreed fee of RM3.00?

So That's all how I withdraw money from PayPal account to banking account in Malaysia in year 2022.

By the way, is there any other best alternatives of PayPal (except TransferWise/Wise) to receive Payment from oversea especially United States & India with relatively lower cost?

Calculations and Study Suggestion for SOA Exam Time Mangament and Planningon SOA Exam FM How to be fully prepare for actuarial exam Analysis of the Pros and Cons of ASM Study Manual