***All contents here are translated from my mandarin blog without changing chronological part (timeline), therefore there might be some timeline dispute between the contents and posts release date.***

How to create Google AdSense account? How to get Google AdSense Approval for Blogger? How to get Google AdSense Approval with less than 20 posts? How to join YouTube Partner Programme?

How to

check my IPO application status(Maybank2u)

- Enter Maybank2u website

- Click Apply on the top columns after login.

- Click Investment in the middle bar when you enter to this page.

- Scroll down to View IPO

Status,and then click Apply Now

- You may see all your current and past IPOs status at

the moment.

|

| Step 5 |

|

Columns |

Meaning |

|

Issuing

House |

Usually are

these 2 issuing houses: TIIH –

Tricor Investor & Issuing House MIH – Malaysian

Issuing House |

|

Share Issue No |

Issuing code of the IPO (start

with either T or M) |

|

Share

Name |

IPO Company Name |

|

Units Applied |

The total units of

shares an applicant applied during IPO application period. |

|

Amount |

The total balance an applicant paid to apply an

IPO. |

|

Channel |

Normally it will show M2U

here |

|

Status |

The status of

IPO at the moment when you login, there are 5 of them which are : · Pending (You still

need to wait for the update) · Partially Matched

(You get part of your applied shares) · Successful (You get all

your applied shares) · Unsuccessful (You

didn’t get any allotment) · Auto Reserved (Your

IPO application is settled) |

|

Reimburse Amount |

It will show the amount

after deducting the amount need for your partially successful/successful

shares allotted. If your status showing

unsuccessful, the amount here will be identical with the initial amount you

applied before. |

|

Partial/Successful

Amount |

It will be RM 0

if your status shows unsuccessful It will be the

amount equivalent to the allotted shares * IPO price per unit under partially

successful/successful. |

When the issuing house release an upcoming IPO’s balloting

results or basis of allotment, usually the banks will start to update the

status of eIPO applicants on evening/night on same day.

However, the speed and business days used for these banks to update eIPO

application status are varied for each IPO.

Some banks could immediately update eIPO application status

few hours after balloting results was released by issuing house while some

banks could take few business days to update eIPO application status.

Even sometime when you are able to get the status update on

same date in an IPO. But next time when you apply eIPO with the same bank, your

application status could be update in next business day or even further.

Therefore, you shouldn’t expect that you can get the results

when someone get it earlier than you. It is depending on your luck and the bank

efficiency to proceed with the allocation.

The speed on updating eIPO application status could be

always affect by other factors from type of bank use to made application. These

factors could be

1)

Tremendously High Oversubscription Rate

2)

National Public Holiday

Mobilia IPO is a good example

on how Malaysia national public holiday could affect the process to update eIPO

application status.

The balloting of application

of Mobilia IPO happened on 11th February 2021, which was coincidentally

same with the date of Chinese New Year eve.

Our market was opened for half

day until 12:30 P.M. on that Thursday and Tricor Issuing & Investor House

(TIIH) released Mobilia IPO’s balloting result on evening.

However, most of the banks

including the one I’m had used to apply Mobilia, they didn’t update the eIPO

status as expected. Maybe because CNY holiday as it is not the usual 1-day

public holiday and most Chinese were having leaves before CNY eve.

Let me take a usual process on how eIPO application status is updated with Optimax IPO.

·

6th Aug Evening – Announcement on balloting results

·

6th Aug Night – I received status update from Maybank2u with

refund on late night on same day.

·

8th Aug 2:00 P.M. –

eIPO applicants from PBe received their update on the application status.

·

11th Aug Night – Finally someone from a forum said that CIMB

update the status.

But the timeline for update on Mobilia eIPO

application status was like this:

·

11th Feb Evening – Announcement on balloting results

·

11th Feb Night – None of the banks update the status.

·

15th Feb Noon. – CIMB update eIPO application status

followed by PBe and Maybank(on night).

For the refund or repayment of those unmatched amount

(Failed/Partially Matched) will be happen after your eIPO application status is

updated from pending status.

Tricks

to apply/buy IPO

Although we can't decide on what is the success rate of getting the allotment of IPO shares. But we still have some trick to apply, invest or buy these IPOs effectively.

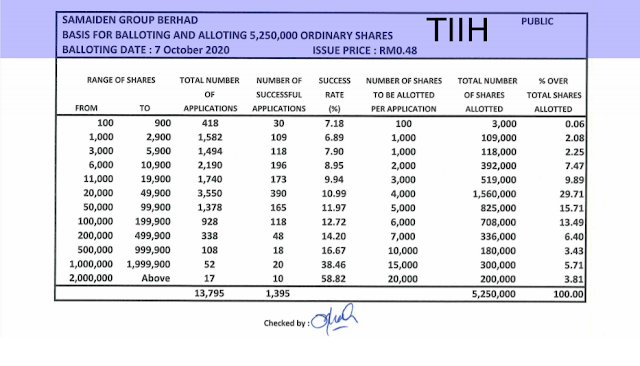

Let has a look on few examples of TIIH’s and MIH’s IPO Basis of Allotment

IPO’s Tier List

Did you observe that the range of the number of shares are

identical for each issuing house’s basis of allotment? And we will normally call these ranges of the

number of shares as “Tier”.

Both of the issues house has some similar structure on the

tier with over 1000 units shares.

For most IPOs before 2020 that were related with TIIH (Those IPOs before Solarvest), the tier will be begin with

additional 100 units in their range. While IPOs related to MIH has a neatly

range that begin with 000 (e.g. 1000 shares, 20000shares etc.).

Both IPOs after 2020 under TIIH and MIH are similar to MIH

structure with 000 as beginning in the range.

(Ignore this as Teladan and Flexi IPOs are not applicable to

this condition).

So based on these fixed range of shares (or Tier), you may

confirm with the minimum number of shares on a tier that you are affordable

before you apply for an IPO.

I will use an example to illustrate this minimum number of

shares with Mobilia as our reference.

Mobilia IPO price per share is RM0.23 and assume I have a

capital of RM10,000 can be used to apply IPO.

I can apply around 434 Lots of shares , or 43400 units of

shares, without considering any application fee.

But it is necessary to apply 434 Lots shares for Mobilia IPO

?

Applying 434 Lots of shares is within the tier of 200 Lots

and 499 Lots, 7th Tier.

You must be wondering is there any problem with applying 434

Lots but look closely. The reason is few columns behind and see at 6th column “number of shares to be allotted …”

So look at here, this mean that every successful

applicants form this tier will get 60 Lots of Mobilia shares.

Did you notice a problem?

Those who applied 200 Lots paid RM4600 while those who

applied 499 Lots paid around RM 11500. But both get same number of shares (if

successful) while the amount paid is differ by 2.5 times.

Therefore you don’t have to prepare RM10,000 to apply

Mobilia but only RM4,600 with some application fee.( You may see the applicationfees image for each bank ).

You don’t have to waste the opportunity cost on the

remaining amount from RM10,000. So don’t

waste your time and your opportunity for interest income or trading/investment

chance.

18th March 2021 : The IPO Efficiency Calculator

is open to every reader with terms and conditions , you may refer to this post.

Endings

This Excel File is made based on my experience

on few IPO application in past few years. It may not be applicable anymore If

there are any changes in the future.

The content of this Excel File is strictly

prohibited from being reproduced or used for any commercial or profit purpose

without my permission. Please obtain my authorization and mention the source

before forwarding or quoting this excel file.

Currently, this Excel is open to any reader to download when you subscribe to my blog and contact me or leave your Email address in comment section.

IPO Series Posts

Malaysia IPO Tutorial Part 1 - How to Apply or Buy IPO?

Malaysia IPO Tutorial Part 2 - Where to check for Balloting Results Announcement?

Malaysia IPO Tutorial Part 3 - Am I a lucky guy to get an IPO?