Ecomate Holdings Berhad ("Ecomate") introduced its own IPO Prospectus on last Friday and you can download the prospectus on Bursa Malaysia. Meanwhile, the last IPO, CEKD Berhad's share price spiked tremendously to nearly a ringgit. Who knows Ecomate is going to perform like CEKD did after its listing? But you should read the following content to simply review of this Ecomate IPO.

Introduction of Ecomate

Ecomate is an investment holding company with headquarter in Muar, Johor. Through its wholly owned subsidiary i.e. Ecomate Sdn Bhd, it is principally engaged in the production of ready-to-assemble furniture products, where it undertakes design and development, production as well as marketing and sales of living room furniture, bedroom furniture as well as other types of furniture.

Ecomate's customers consist of various distribution channel including Distributors, Wholesalers, Retailers and E-commerce sellers. Distributors and Wholesalers are the main contributors to company sales in past 3 FYEs and its products are mainly sold overseas to countries across Asia, Europe and North America.

Ecomate is a new player in furniture industry as it was established in 2016 with headquarter located in Muar, Johor. But it doesn't mean Ecomate has little or none advantages in this industry, instead, one of Ecomate's founder, Koh Cheng Huat (Executive director of Ecomate) had been involved in the furniture industry for over 20 years.

Since Ecomate Holdings Berhad IPO is similar with Ramssol Group IPO and CTOS Digital IPO, the term sheet document of Ecomate was not disclosed by Malaysian Ministry of International Trade and Industry (MITI).My previous article has a detailed record of how to view this information through MITI. For those who are interested, you can refer this post for more information (in mandarin).

The following IPO details of Ecomate is extracted from its final IPO Prospectus

- IPO Price Per Share :RM 0.33

- IPO Application (Begin) :15th October 2021

- IPO Application (End) :25th October 2021

- Balloting of application :28th October 2021

- Listing Date(Tentative) :8th October 2021

- IPO Listing Market :Ace Market

Ecomate’s Diluted Earnings Per Share (EPS) recorded in the past 4 financial years ended from 2018 to 2021 were 0.06sen, 0.95sen ,1.16sen, and 2.43sen, respectively. So based on the IPO price of RM 0.33, Ecomate’s P/E Ratio is 13.56 times which is still reasonable from my perspective as most Ace Market IPO has a P/E range between 10 to 20.

Ecomate Holdings Berhad has an Enlarged share capital of 350 million shares after its listing in Ace Market. It includes the issuance of 49 million new shares (14% of enlarged share capital) with 30 million existing shares (8.6% of enlarged share capital) offer for sale to selected investors through private placement.

Public issue of 49,000,000 new ordinary shares in Ecomate is in the following manner:

- 17,500,000 New shares available for application by the Malaysian public;

- 8,750,000 New shares available for application by our eligible directors,employees and persons who have contributed to the success of our group;

- 22,750,000 New shares by way of private placement to selected investors; and

- 0 New shares by way of private placement to Bumiputera

The funds raised by Ecomate through IPO will be used for the following purposes :

- 37.1% Capital expenditure - Machinery & Equipment

- 12.4% Factory & Hostel Construction

- 32.6% Purchase of Raw Materials

- 17.9% Estimated Listing Expenses

Ecomate Berhad doesn't have any formal dividend policy as disclosed in the initial version of IPO prospectus.

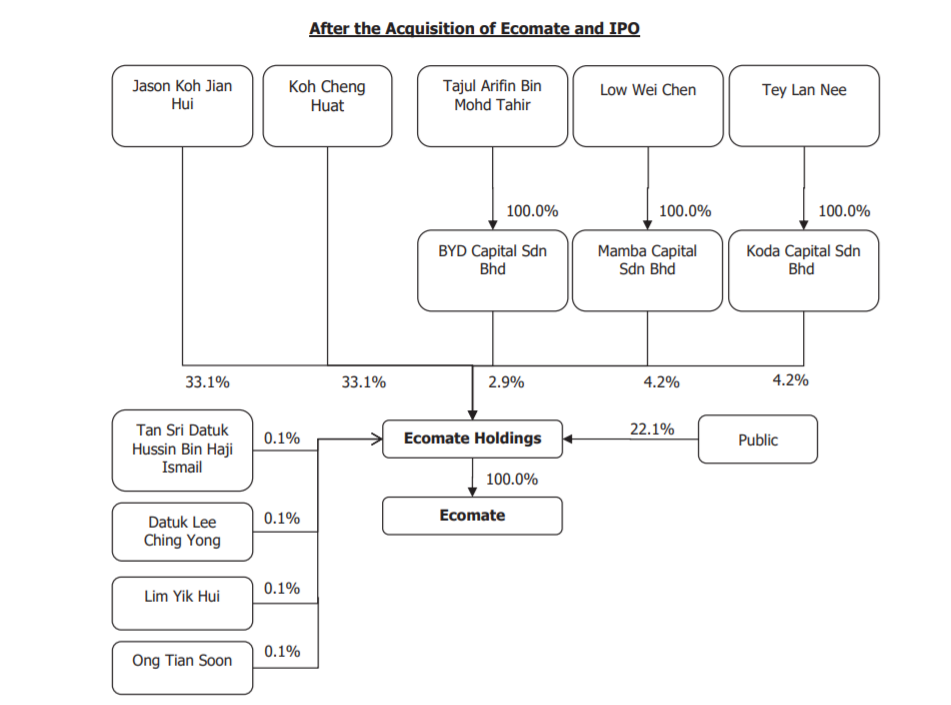

Lastly, this is the shareholdings structure of Ecomate Holdings Berhad after IPO:

Other IPO Posts (List)

Malaysia IPO Tutorial List (English)

Malaysia IPO Tutorial List (Chinese)

Malaysia IPO Tutorial Part 1 - How to Apply or Buy IPO?

Malaysia IPO Tutorial Part 2 - Where to check for Balloting Results Announcement?

Malaysia IPO Tutorial Part 3 - Am I a lucky guy to get an IPO?

Malaysia IPO Tutorial Part 5 - My Efficient IPO Calculator

Disclaimer: This article is only used for sharing and personal recording purposes. This site will not be responsible for any profits or losses made by anyone for any investment /speculative action.

YouTube Partnership Program How to link adsense to a website and YouTube channel? What happens after become a YouTube Partner How to buy Domains from Google? Why Google Domains is better than GoDaddy?