Recent IPO News - Ecomate Listing & Orgabio Coming Soon

Recently, in addition to the launch of Ecomate's IPO prospectus in last Friday, Orgabio should also going to be listed on the ACE Market of Bursa Malaysia Stock Exchange after it issued its IPO prospectus few weeks ago. Apart from the upcoming listing of these two companies, there is one more company has also updated the draft IPO prospectus on SC's official website.

The company that is about to go public through IPO is a Electronic Manufacturing Service (EMS) provider, Aurelius Technologies Berhad ("Aurelius Technology" or "ATech")

Company Background of Aurelius Technologies

According to the IPO prospectus on SC's official website, Aurelius Technologies Berhad is a investment holding company that provides One-Stop Service Solution Provider for industrial electronic products throught its only wholly-owned subsidiary, BCM Electronics.

Up to now, ATech provides electronic manufacturing services ( Electronic manufacturing services, EMS) for 3 product categories to local and foreign customers, namely

- Communication and IoT products;

- Electronic Equipment; and

- Semiconductor components

Among these 3 product categories, the EMS business of communication and IoT products account for nearly 90% of ATech FYE2021 revenue.

ATech's main operations are located in Malaysia and provide services to as many as 11 companies in Asia, Europe and North America. Among them Malaysia, Singapore and the United States contributed an average of more than 90% of ATech's revenue in the past three FYEs .

Details of Aurelius Technologies IPO

The following information is based on the information about the company Aurelius Technology disclosed by the Ministry of International Trade and Industry (MITI) of Malaysia. My previous article has a detailed record of how to view these information through MITI. If you are interested, you can read the previous article.

- IPO price per share: RM1.36 (to be determined)

- IPO application open day: November 29, 2021

- IPO application deadline: December 3, 2021

- Date of announcement of draw results: early December 2021

- IPO Expected Listing Date: December 16, 2021

- Aurelius listed market: Main Market

Aurelius Technology has approximately 358.18 million shares of enlarged share capital after its complete the fund rasing and shares transfering through IPO. This includes the issuance of 77.01 million new shares (21.50% of the enlarged share capital) and the offer sale of 26.86 million shares by shareholders (7.50% of the enlarged share capital) .

Of the 103.87 million shares (29.00% of the enlarged share capital) issued by ATech in its initial public offering (IPO), 22,099,000 shares belonged to the Retail Offering (6.40% of the enlarged share capital) , and the remaining 80,961,000 shares belonged to Institutional Offering (22.60% of the enlarged share capital) .

- 17.9 million shares for the Malaysian public to subscribe ,

- 5 million shares reserved for qualified directors, employees and business partners,

- Private placement of 44.7725 million shares to selected investors, and

- 36,188,500 MITI designated Bumiputera investors.

Since the IPO price of Aurelius Technology has not been announced, the market value and price-earnings ratio of ATech at the time of listing are still unknown.

Shareholding structure of Aurelius Technology

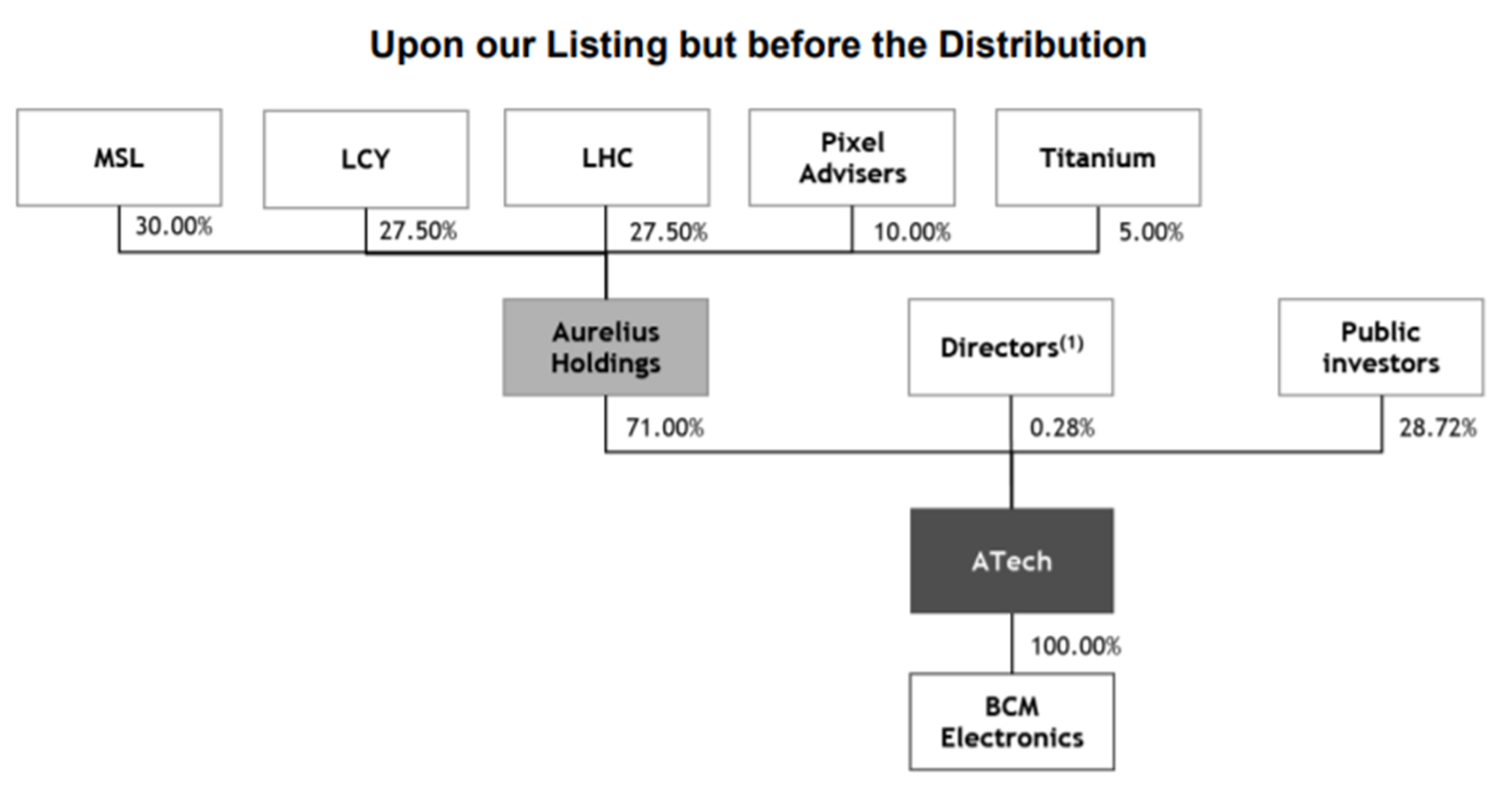

The shareholding structure of Aurelius after listing is as follows:

- Aurelius Holdings 71%

- Directors holds 0.28%

- The Public holds 28.72%.

In the shareholding structure of the largest shareholder of Aurelius Technology Berhad, Aurelius Holdings, there are 3 important major shareholders, namely:

- MSL, Main Stream Limited (a company of LCY and LHC)

- LCY , Lee Chong Yeow, Executive Director and CEO

- LHC , Loh Hock Chiang, Executive Director and CFO

However, the major shareholder Aurelius Holdings will conduct an equity allocation 6 months after the listing of Aerulius Technology. MSL, Pixels Advisors and Titanium will all get their respective equity quotas and leave Aurelius Holdings afterwards. (Shares in Aerlius Holdings % * 71%) .

Aurelies Holdings will hold a 22.05% stake in order to maintain its own operations as a holding company after it distribute the proportional shares to others shareholders prior to this. After that, Aurelius Holdings' shareholders are LCY and LHC , each holding 50% of the equity of this holdings company.

After deducting the equity distribution of LCY and LHC , each person can get 8.5% of ATech's equity, plus 0.03% of the equity as a director, and finally LCY and LHC directly hold 8.53% of ATech's equity.

Aurelius Technology - Utilization of IPO Proceed

Aurelius Technology will use the funds raised in the IPO to purchase new machinery and equipment , repay bank debt, use as working capital and to pay listing fees etc., but the percentage of each project is not stated in the draft of the IPO prospectus.

Aurelius Technology intends to expand its business into Semiconductor Component Manufacturing through capital raising , ATech is also looking for an opportunity to expand the current existing 2 production lines for Customer F 's semiconductor component manufacturing to 7 production lines by the end of 2023 to meet Customer F's growing industry needs.

The brief introduction of Customer F is: Customer F is engaged in the wireless communication industry, mainly engaged in the design, production, R&D and sales services of wireless communication modules and solutions in the field of Internet of Things. The company is incorporated in China. Client F is a public company listed on the Shanghai Stock Exchange with its headquarters in China.

Based on the details givne by Aurelius Technology, the listed company in China that fullfil the criteria is - Quectel Wireless Shanghai Quectel Communication Technology Co. , Ltd. , codenamed SHA: 603236.

In addition, ATech plans to launch a new product, namely the manufacture of lithium-ion battery pack systems for light vehicles . Based on its IPO prospectus, ATech is currently working with third parties in the development phase of the lithium-ion battery pack system.

In order to be able to expand its EMS business and develop lithium-ion battery pack systems for light vehicles, ATech intends to build a new factory to expand the scale of its production facilities.

ATech has now begun construction of the new manufacturing facility on approximately 3 acres of open space adjacent to the existing manufacturing facility. The new single-story manufacturing facility covers an area of 61,909 square feet.

At the same time, Atech has also purchased some new machinery and equipment, such as the two production lines that have been ordered and purchased, and the investment in 4 new production lines in order to further expand the production facilities. These new machinery and equipment can meet the requirements of Aurelius Technology EMS. Business expansion and growth needs.

Aurelius Technology - Dividend Policy

As ATech is a holding company, its income and therefore, its ability to pay dividends is dependent upon the dividends that it receive from its subsidiary, BCM Electornics. Distributions by Atech's subsidiary will depend upon its operating results, earnings, capital requirements, general financial condition and other relevant factors. The board of directors of ATech targets a payout ratio of 20% of its Profit after Tax attributable to owners of the Company of each financial year on a consolidated basis after taking into account working capital requirements, subject to any applicable law and contractual obligations and provided that such distribution will not be detrimental to ATech Group’s cash requirements or any plans approved by the Board.

Endings

So the above is a basic introduction about Aurelius Holdings Berhad "ATech", the next November and December are likely to usher in many IPOs and new listings, such as furniture manufacturer Ecomate, logistics companies MTT Shipping & Logistics and Swift Haulage Berhad , Malaysia's domestic electrical retailer SenHeng New Retail Berhad Emerging Electrical Appliances and more.

By the way, Aurelius will be the second tech IPO in 2021 after Ramssol Group Berhad, if no other IPOs come on the scene (especially the UWC-related IPO of Coraza Integrated Technology Berhad).

How to get free eu.org domain how to transfer domain to another domain registrar eu.org team reject my domain registeration? Eu.org domain websites' sitemap error